Virginia’s Enterprise Zone

The Virginia Enterprise Zone (VEZ) program is a partnership between state and local government that encourages job creation and private investment. VEZ accomplishes this by designating Enterprise Zones throughout the state and providing two grant-based incentives, the Job Creation Grant (JCG) and the Real Property Investment Grant (RPIG), to qualified investors and job creators within those zones, while the locality provides local incentives.

GRANT YEAR 2020

Applications for Grant Year 2020 will be due April 1, 2021. Instruction manuals and Agreed Upon Procedures for the CPA Attestation are now available at the links below.

Grant Year 2019 How-to-Qualify Presentation

Grant Year 2019 How-to-Qualify Frequently Asked Questions

VEZ Application Submission System

ELIGIBILITY

VEZ State Incentives are available to businesses and zone investors who create jobs and invest in real property within the boundaries of enterprise zones.

- Qualification for the Job Creation Grant (JCG) is based on permanent full-time job creation over a four job threshold, wage rates of at least 175 percent of the Federal minimum wage (150 percent in HUAs*), and the availability of health benefits. Personal service, retail, food and beverage positions are not eligible to receive job creation grants. **As of 2010, firms located in High Unemployment Areas (HUAs) may qualify for the JCG at the reduced wage rate threshold of $10.88 (150 percent of the Federal minimum wage). A list of HUAs is provided below in the Helpful Links section of this page.

- Eligiblity for the Real Property Investment Grant (RPIG) is based on qualified investments made to commercial, industrial, and mixed-use buildings or facilities located within the boundaries of an enterprise zone. To be eligible for the RPIG, an individual or entity must invest at least $100,000 for rehabilitation or expansion projects and at least $500,000 for new construction projects.

For more information about state incentive eligibility criteria and grant awards please reference the Virginia Enterprise Zone Grant Matrix under the “Helpful Links “section.

Real Property Investment Grant and Job Creation Grant applications should be submitted to DHCD (electronically and hard copy) by April 1, 2021, along with a copy of the Commonwealth of Virginia W-9 Form.

FUNDING ALLOCATION REVISIONS

In an effort to prioritize job creation, Job Creation Grants will receive funding priority should grant request exceed available funds. In the event that grant requests exceed allocated funding, Real Property Investment Grants may be subject to proration.

JOB CREATION GRANT REVISIONS

The Virginia Enterprise Zone (VEZ) Job Creation Grant (JCG) has reduced the wage rate threshold for job grants in areas with unemployment rates that are equal to or more than one and one-half times the state average to 150 percent of the federal minimum wage or $10.88 to receive grants. High unemployment area zones authorized by this new provision are listed on the link below.

| Wage Rate Threshold* | Grant Per PFTE | Eligible Businesses |

| $10.88 | $500 | HUA BUSINESS |

| $12.69 | $500 | ALL BUSINESS |

| $14.50 | $800 | ALL BUSINESS |

PARTNERS/INTERMEDIARIES

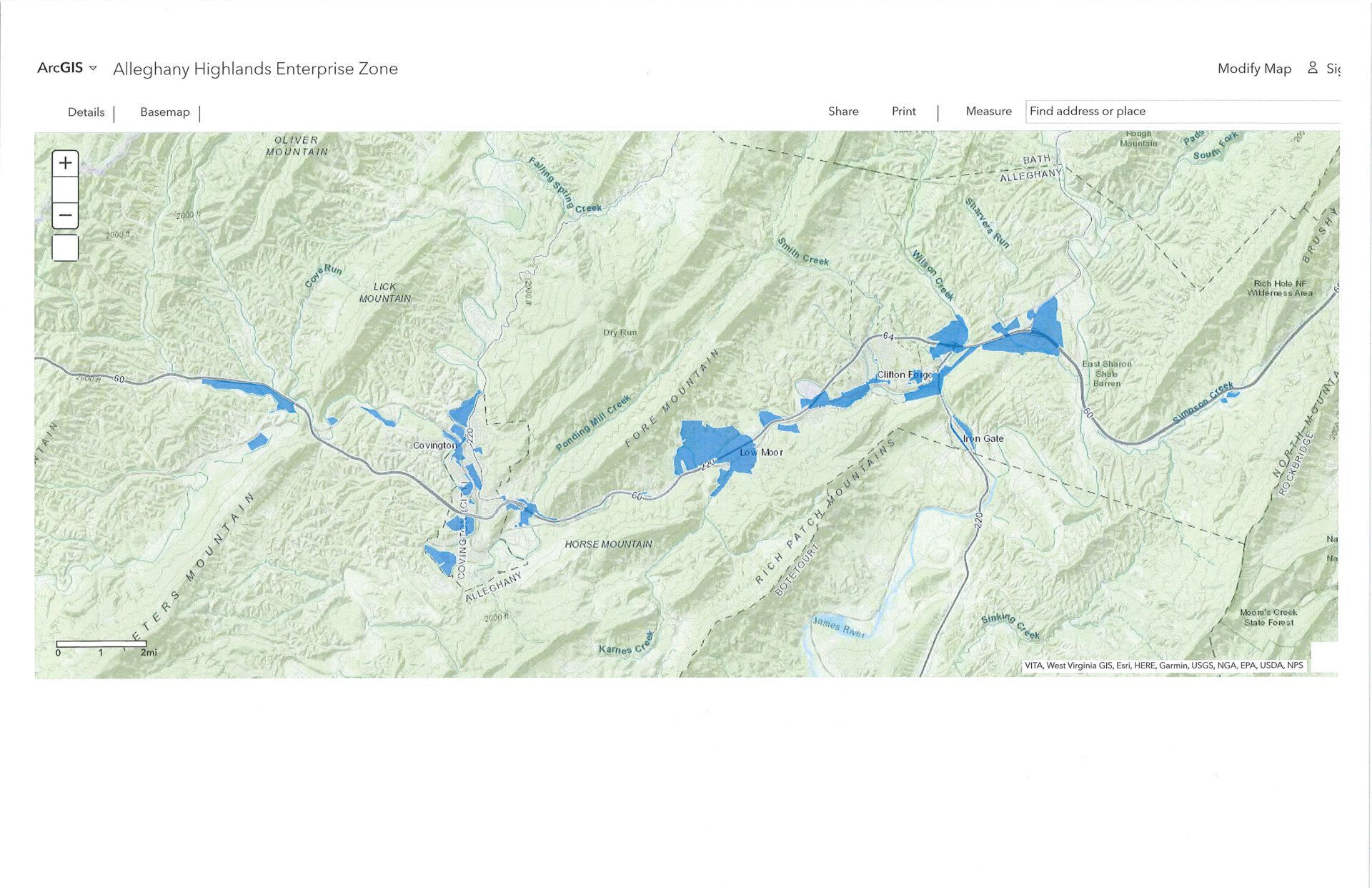

In addition to state incentives, each locality offers its own package of incentives tailored to their unique needs. To find out whether a business or real property is located within an enterprise zone, or to learn more about a specific zone’s local incentive package, see map here.